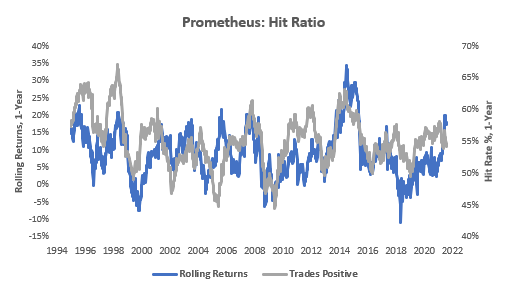

Last week, our Alpha Strategy suffered losses as market moves turned against Commodity & Equity exposures. These losses were somewhat offset by gains in FX exposures, i.e., long USDMXN. Our Hit Ratios on a rolling one-year basis remained at 54%, but down from the peak earlier this year at 57%:

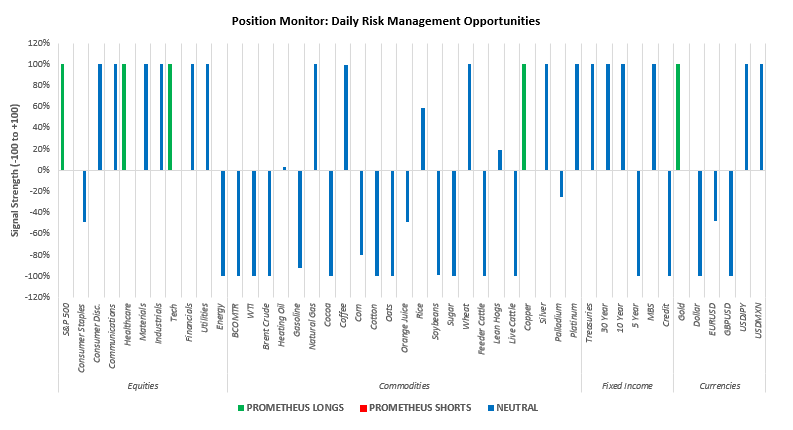

Turning to next week, our systems now have confirmed positions for the next week:

The Prometheus Alpha Strategy is LONG: S&P 500, Healthcare, Tech, Copper, Gold. Our Beta Rotation Strategy is currently LONG: Commodities. A Market Regime Portfolio would be allocated to Stocks & Credit: 4%, Commodities: 57.4%, Treasuries & IG Debt: 0%, Gold & TIPS: 5.3%, Cash: 33.5%.

With regards to economic data, here are the data points most relevant to our systematic tracking of economic conditions:

Monday: Dallas Fed Manufacturing Index

Tuesday: Durable Goods Orders, FHFA Home Price Index, Richmond Fed Manufacturing Index, New Home Sales

Wednesday: Retail & Wholesale Inventories, Pending Home Sales,

Thursday: Jobless Claims, Kansas Fed Manufacturing Index

Friday: Personal Income, Personal Spending, MNI Chicago PMI

PMI & Manufacturing data look set to slow according to our High-Frequency Impulse metrics, further corroborated by last week’s Philly Fed Business Outlook data. Furthermore, based on our near-casting for growth and inflation, personal income & consumption data are likely to show significant weakness on a year-over-year basis. Our Inflation Nowcasts show strong resilience in inflation rates, and growth look set up for a challenging week ahead. We remain incredibly close to triggering outright equity shorts but are waiting for signal confirmation. In the meantime, equity exposure should be limited, given the high noise to signal ratio we are currently seeing.