Click here to enter The Observatory.

The Observatory is how we systematically track the evolution of financial markets and the US economy in real-time. Without further ado, let’s dive into what our systems are telling us:

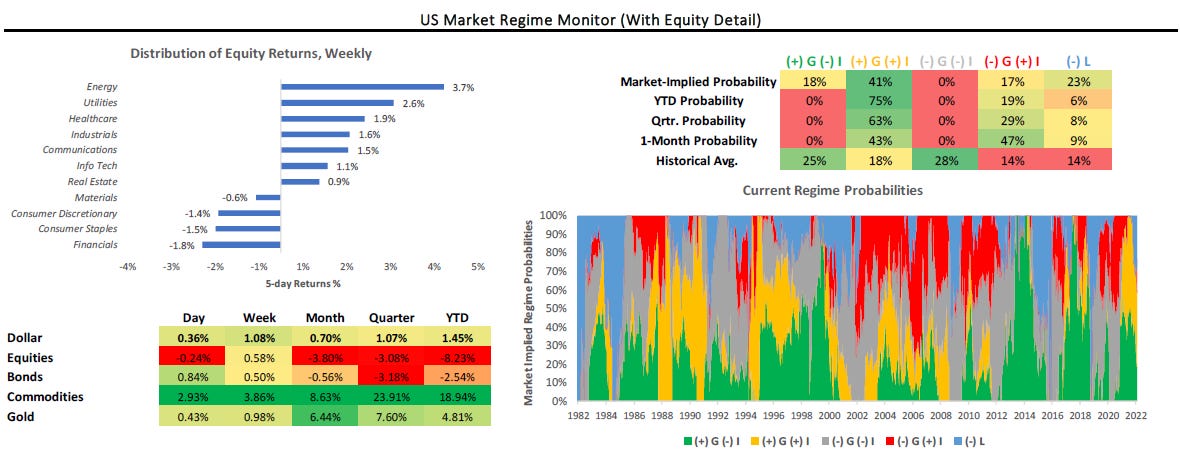

Markets: Thus far, this week has been good for our strategies, both from an Alpha and Beta perspective. On the Alpha side, last week's counter-trend moves in Equities, Gold, and Treasuries created strong risk-reward setups for us to add positions. Thus far, Gold and Bond positions have paid off well. On the Beta side, allocations in commodities continued to grind higher, albeit with higher realized volatility. While markets continue to decisively price (+) G (+) I, the implied probabilities of other regimes remain elevated, i.e., regime risk remains high. While Beta Rotation has been a great strategy this year, we expect it to get considerably harder over the next few months as macroeconomic factors converge towards a potential shift.

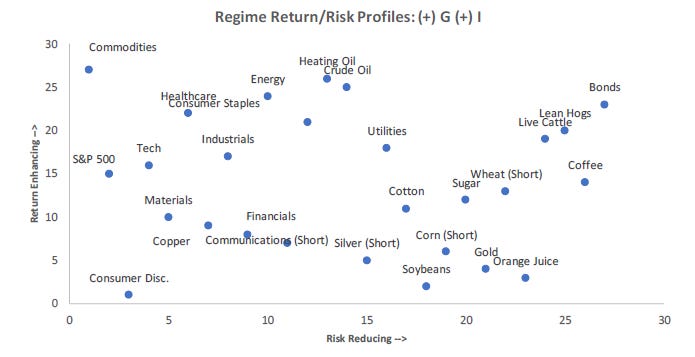

To summarize our systems' current assessment: Our Market Regime Monitors show that we are in a (+) G (+) I regime. Inflation dominates as we begin March. Our Momentum Monitors show that Treasuries have bounced from their depressed levels, now with a Momentum Score of 8%. However, inflation momentum remains the dominant cross-asset trend. The market-implied probability of (-) G (+) I has recently risen sharply, increasing the potential for a regime shift. Gold and Commodities remain well supported during both (+) G (+) I or (-) G (+) I. Consequently, our systems tell us that the best opportunities are LONG: Bonds, Gold, Cotton, Lean Hogs, Live Cattle & Sugar, and Short: Communications. However, our Risk Management Monitors indicate that we can ADD to LONG: Bonds, Lean Hogs, Live Cattle, Sugar, and SHORT: Communications. We can REDUCE our LONG: Gold & Cotton. Our Expected Return Strategy is LONG: Bonds, Gold, Cotton, Lean Hogs & Sugar, and SHORT: Communications.

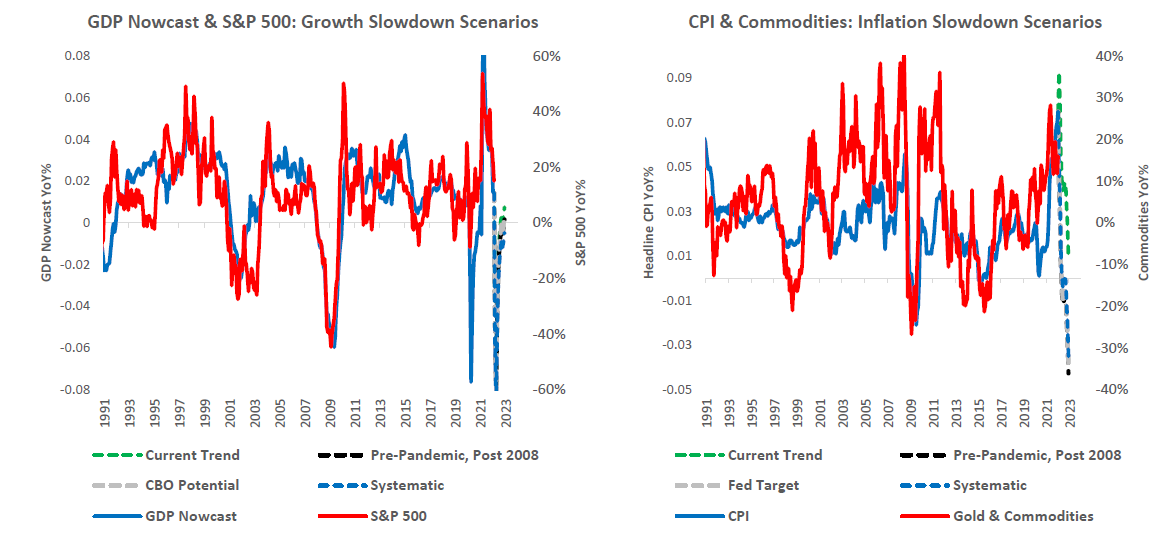

Macro: Yesterday, MNI Chicago PMI disappointed expectations, Dallas Fed Manufacturing Survey surprised to the upside, and Retail Inventories were higher than expected. This mix of economic data kept Economic Momentum elevated, but the trend in data remains weaker. Today, we will receive ISM Mfg. Data, which will be valuable to our GDP Nowcast.

To summarize our systems' current assessment: The latest economic data have marginally pushed our GDP Nowcast higher, to 1.5%, and Economic Momentum remains elevated relative to the downwards trend in economic growth. Since September 2021, our systems have called for a material GDP growth slowdown in March-April 2022. Further, they estimate that CPI will slow from its currently torrid pace. These moves are highly likely and show little sensitivity to our various stress-test scenarios. However, there is likely to be a window of time during which growth falls faster than Inflation, creating a window for (-) G (+) I before an eventual transition to (-) G (-) I.

The future is dynamic, and our systems adjust as new information is available. Our bias is to allocate for the existing regime while trying to peek around the corner to what the future may hold. Finally, we optimize these views to minimize portfolio risk, resulting in our trading signals. We show all this in the document below.

Click here to enter The Observatory.