Click here to enter The Observatory.

The Observatory is how we systematically track the evolution of financial markets and the US economy in real-time. Without further ado, let’s dive into what our systems are telling us:

Markets:

Our Alpha strategy is likely to end the week on a highly positive note, having added exposures aggressively after the prior weeks' counter-trend moves, barring any significant changes to cross-asset conditions into the close today. Our Gold, Treasuries, Communications (short) & Sugar positions all offered considerable risk-adjusted returns. Our Beta Rotation strategy continued to provide positive returns, with Commodities aggregates rallying on global geopolitical tensions. Looking to the week ahead, Regime Risk remains elevated, with risk-off regimes commanding a high and increasing share of market-implied probabilities. Further, opportunities declined to add exposure this week after significant dislocations the prior week. All else equal, our Alpha strategy is likely to reduce the number of exposures next week and is currently only pointing to Cattle as a viable opportunity.

To summarize our systems' current assessment: Our Market Regime Monitors tell us we are in a (+) G (+) I regime, with a significant risk of (-) G (+) I and (-) L this week. Gold and Commodities remain well supported during both (+) G (+) I or (-) G (+) I. Our systematic forecasts point to (-) G (+) I regime, followed by an eventual transition to (-) G (-) I. Gold would be a bridge between these regimes. Further, our Momentum Monitors shows that Gold continues to add trend support as markets continue to increase their pricing of inflation. Commodities as well remain buoyant, with solid trend support. Falling inflation assets (Equities & Treasuries) continue to suffer. Consequently, our systems tell us that the best opportunities are LONG: Bonds, Gold, Cotton, Lean Hogs, Live Cattle & Sugar, and SHORT: Communications. However, can ADD to LONG: Bonds, Lean Hogs & Live Cattle, and SHORT: Communications. We can REDUCE our LONG: Gold, Cotton & Sugar. Our Expected Return Strategy is LONG: Bonds, Gold, Cotton, Lean Hogs & Sugar, and SHORT: Communications.

Macro:

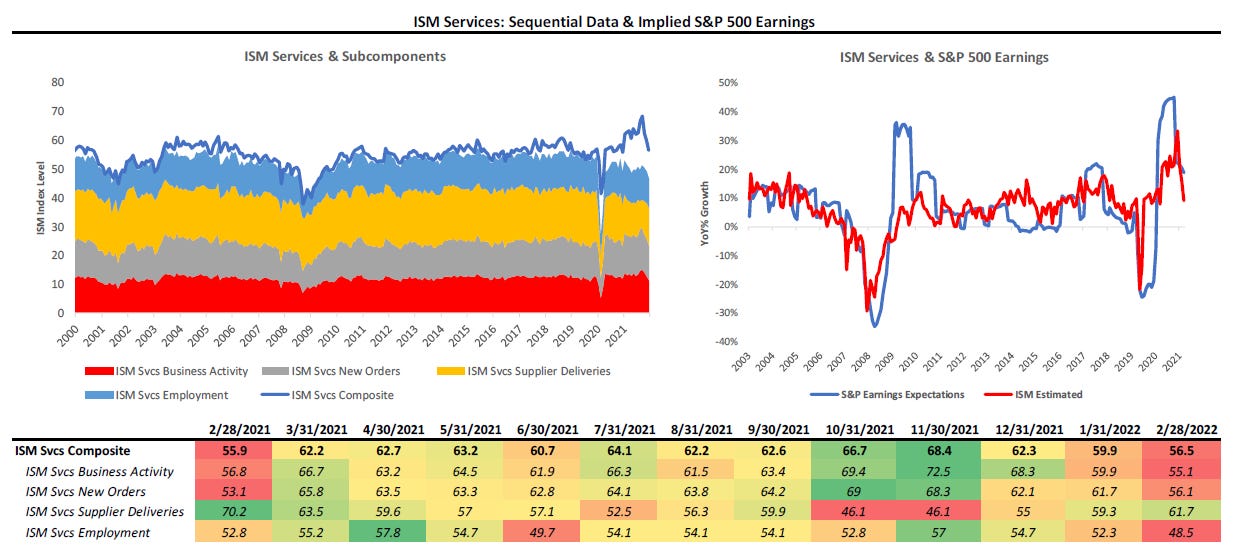

Recent economic data resulted in a bounce in our growth and inflation Nowcasts. However, while notable, the bounce in growth is not adequate to change the cyclical outlook.

To summarize our systems' current assessment: The latest economic data significantly boosted our GDP Nowcast, with economic growth tracking at 2%. Coincidently, Economic Momentum remains elevated at 66%. Nonetheless, cyclical slowdown effects are likely to lower these numbers in months to come. Our CPI Nowcast accelerated further. This acceleration in broad-based inflation measures suggests the potential for an environment where cyclically, CPI mean-reverts to lower levels, yet the market pricing of inflation remains elevated, and trend strength in commodities continues. The decelerations we have expected since Sept 2021 are now imminent on the forecast horizon. Data is likely to turn for the March-April reporting period.

The future is dynamic, and our systems adjust as new information is available. Our bias is to allocate for the existing regime while trying to peek around the corner to what the future may hold. Finally, we optimize these views to minimize portfolio risk, resulting in our trading signals. We show all this in the document below.

Click here to enter The Observatory.