The Observatory is how we systematically track the evolution of financial markets and the US economy in real-time. Due to the strong demand for the product, we will start sharing the beta version of The Observatory (click to download) as we finalize its designs. This will offer a high-frequency resource to those using our systematic macro approach, allowing them to “Observe” the macroeconomy through our quantitative lenses. We will soon be launching the product officially, i.e., with explainer materials and a standardized format. And don’t worry, it’s all still free! Also, make sure to follow us on Twitter for timely updates:

Without further ado, let’s dive into what our systems are telling us:

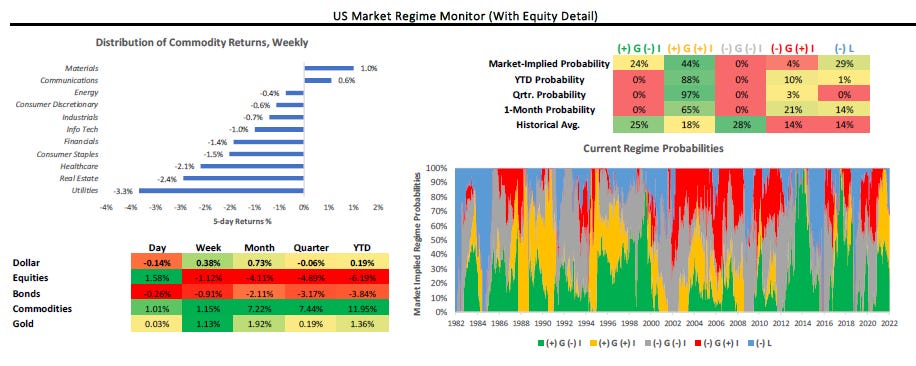

Markets: Markets extended their pricing of (+) G (+) I overnight, with Equities up on the day yesterday and Commodities opening strong today. Under the surface, Commodities showed a fair amount of dispersion, creating opportunities to add positions. Treasuries continue to be a challenging exposure on the long side, with relentless downside pressure amidst rising inflationary pressures and Fed hiking rhetoric. There are very few periods in recent history where Treasuries have maintained such low trend support, which tells us the degree of these moves is overdone. A reassessment of front-end rate hike expectations remains a potential catalyst for higher Treasuries. The short-end of the curve continues to look oversold according to our risk measures; however, longer durations are much less so.

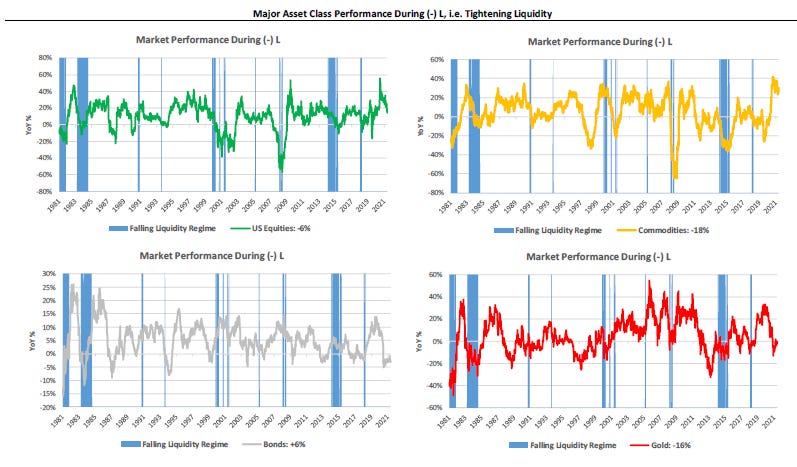

To summarize our systems' current assessment: Our Market Regime Monitors shows a dominance of (+) G (+) I, with a high and rising chance of (-) L, dragging on risk assets. Our Market Regime Signal points to (+) G (+) I; however, (-) L conditions continue to show themselves in markets. This distribution of probabilities poses a significant drag on pure (+) G (+) I allocations and dampens their expected return prospects. Our Momentum Monitors show that Treasury Momentum Scores continue to remain extremely weak. The Treasury market remains under pressure due to the pricing of multiple rate hikes. Consequently, our systems tell us that the best opportunities are Long: Bonds, Cotton, Lean Hogs, Cattle, Sugar, and Short: Communications. However, Risk Management Monitors indicate that we can ADD to LONG: Bonds, Cotton & Sugar, and SHORT: Communications. We can REDUCE our LONG: Lean Hogs & Live Cattle. Our Expected Return Strategy is LONG: Bonds, Cotton & Live Cattle.

Macro: This morning, retail sales and industrial production data both came in stronger than expected and sequentially higher. These remain counter-trend moves in an otherwise deceleration macroeconomic backdrop per our systems. We will receive the FOMC's minutes later today, which will bring incremental information about the path of monetary policy. Markets will likely focus on the potential for a 0.5% hike in March. We will be looking for further clarity on the pace, composition, and timing of quantitative tightening. As we have seen in the past, the shortage of liquidity created by QT puts pressure on the yield curve; as cash assets look for safety, we currently expect this time around to be no different.

To summarize our systems' current assessment: Yesterday's economic data pushed our GDP Nowcast marginally higher, estimating growth at 2.6%. However, Economic Momentum remains relatively unchanged, marginally lower, at 47.2%.

The future is dynamic, and our systems adjust as new information is available. Our bias is to allocate for the existing regime while trying to peek around the corner to what the future may hold. Finally, we optimize these views to minimize portfolio risk, resulting in our trading signals. We show all this in the document below.

Click here to enter The Observatory.