The Observatory is how we systematically track the evolution of financial markets and the US economy in real-time. Due to the strong demand for the product, we will start sharing the beta version of The Observatory (click to download) as we finalize its designs. This will offer a high-frequency resource to those using our systematic macro approach, allowing them to “Observe” the macroeconomy through our quantitative lenses. We will soon be launching the product officially, i.e., with explainer materials and a standardized format. And don’t worry, it’s all still free! Also, make sure to follow us on Twitter for timely updates:

Without further ado, let’s dive into what our systems are telling us:

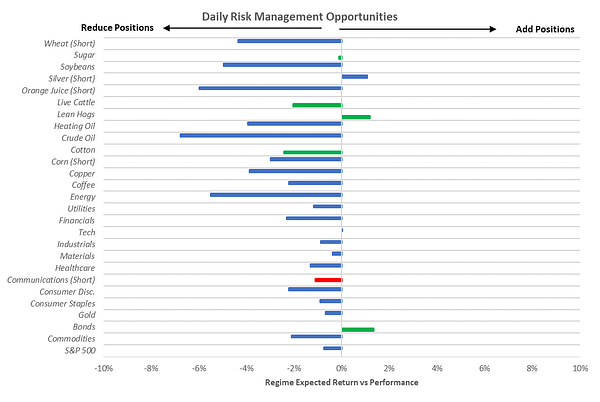

Markets: Last week proved to be once again a volatile one, which was rewarding for our alpha generation strategy, which was long, long Sugar, and short Communications. From a beta-rotation perspective, commodities were once again the place to be, with the commodity complex outperforming once again. There are two dynamics in markets worth noting. First, there is considerable divergence within asset classes, which benefit alpha generation via long-short strategies. Second, there remains a fair amount of regime risk this week, and if pro-growth assets move significantly (which has been typical recently), there is a potential for a regime shift to (-) L. To summarize our systems' current assessment: Our upgraded Market Regime Monitors shows a dominance of (+) G (+) I to begin the week. Despite our systematic forecast of a transition from (+) G (+) I into (-) G (-) I, asset markets have not confirmed this estimate year-to-date. Considering cross-asset correlations, the biggest threat to the current regime remains a sudden transition to (-) L. Consequently, our expected return and risk analysis tells us that the best opportunities are Long: Bonds, Cotton, Lean Hogs, Cattle, Sugar, and Short: Communications. However, our Risk Management Monitors indicate that we can ADD to LONG: Bonds, Cotton, Lean Hogs, & Sugar. We can REDUCE our LONG: Live Cattle and SHORT: Communications. While our Market Regime Signal continues to point to (+) G (+) I; however, from a portfolio construction perspective, our systems tell us it is optimal to be regime-neutral. Dispersion within asset classes is creating significantly more opportunities than asset class rotation. Resultantly, our Expected Return Strategy is LONG: Bonds & Lean Hogs.

Macro: Last week's economic data pushed our GDP Nowcast significantly lower, but Inflation Nowcast remained elevated. This week, US markets are likely to anchor on the upcoming CPI print, which will help them judge the Fed's reaction function. While consensus expects an acceleration in YoY CPI, our systems point in the opposite direction, which would provide a significant surprise to markets. Our Inflation Nowcast has an all-time hit ratio of 58% in estimating the acceleration of CPI (92% over the last year). Sequential decelerations aside, the risk of heightened inflation with slowing growth looks to be increasing. To summarize our systems' current assessment: While we ended the week on a positive note for Economic Momentum (with NFP higher than expected), the aggregation of last week's data pushed our GDP Nowcast down to 2.6%, telling us that the deceleration in growth has picked up steam. Unlike our GDP Nowcast, our Inflation Nowcast shows resilience to decelerations, though they show a sequential slowdown in the cards.

The future is dynamic, and our systems adjust as new information is available. Our bias is to allocate for the existing regime while trying to peek around the corner to what the future may hold. Finally, we optimize these views to minimize portfolio risk, resulting in our trading signals. We show all this in the document below.

Click here to enter The Observatory.

What does it mean (-) L?