Today, we offer updates on our economic and financial near-casts. As always, we focus on what the economic data tell us about the current state of the economy, what markets tell us about expectations, and what our systematic near-casting framework is telling us about the near-term. Our observations are as follows:

Current economic data is pointing to robust economic growth. Our Growth Index is registering peak growth rates across our Risk Premia Index, Production Index, Spending Index, and Employment Index.

The economic impulse coming from government transfers is massive. While most of this income stimulus made its way into increased savings, we see significant potential for this cash to make its way into the real economy.

We are now seeing the redistribution of personal spending that we forewarned beginning in January. Lagging areas of the economy are starting to see a bounce in spending levels, a trend which we expect to continue as the economy continues to open.

Markets continue to imply we are in a rising growth and inflation environment. While maybe some debate about inflation outcomes and sustainability, we think it is indisputable we are in a rising real growth environment. When we look at equity sector performance, we see that current trends are broadly consistent with history.

Our systematic forecasts are pointing to a slowing rate of growth and inflation in August. While levels of growth and inflation will remain elevated, they will likely stop rising at this time. Periods of stagnating growth and inflation have an equity allocation preference that is quite different from the current regime. We show the lessons of history to get a better sense of our future allocation strategy.

Overall, our systems continue to point to strong growth in the near term. This is consistent with our discretionary analysis- we think that we are just at the start of an economic expansion with labor markets still loose, capacity underutilized, and the Federal Reserve still immensely accommodative. Indeed, we do expect the rate of growth and inflation to temper around August, but they will both stay elevated. Hence, while we don’t expect a large risk-off to come from this, there could be a fair amount of leadership change within equities. We discuss all this and more in the pages to come.

Economic Data is Pointing to Robust GDP Growth.

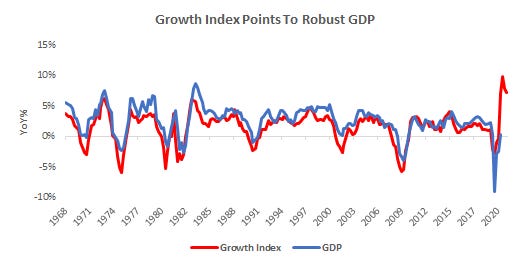

Our Growth Index is our high-frequency measure of the growth impulse to GDP from a wide range of comprehensive economic data. The Growth Index has four subcomponents: risk premia, spending, production, and labor markets. The index aims to measure economic activity at a higher frequency (monthly) and lower latency than quarterly GDP. Current economic data, which feeds the Growth Index, is currently pointing to robust real GDP growth:

As we can see above, the Growth Index does a good job estimating real GDP growth in real time. The Growth Index has a directional accuracy of 88% in nowcasting real GDP growth. More importantly, unlike many regression-fitted estimates, our Growth Index actually has greater accuracy in nowcasting GDP downturns- our downside directional accuracy is 95%. When we think about our Growth Index, we prefer to focus not on the estimated magnitude of the nowcast but rather the acceleration or deceleration of the nowcast. As we can see above, the Growth Index is pointing to an extremely strong nowcast, i.e., GDP Growth will likely peak in Q2 according to our Growth Index.

The Impulse From Government Transfers is Massive.

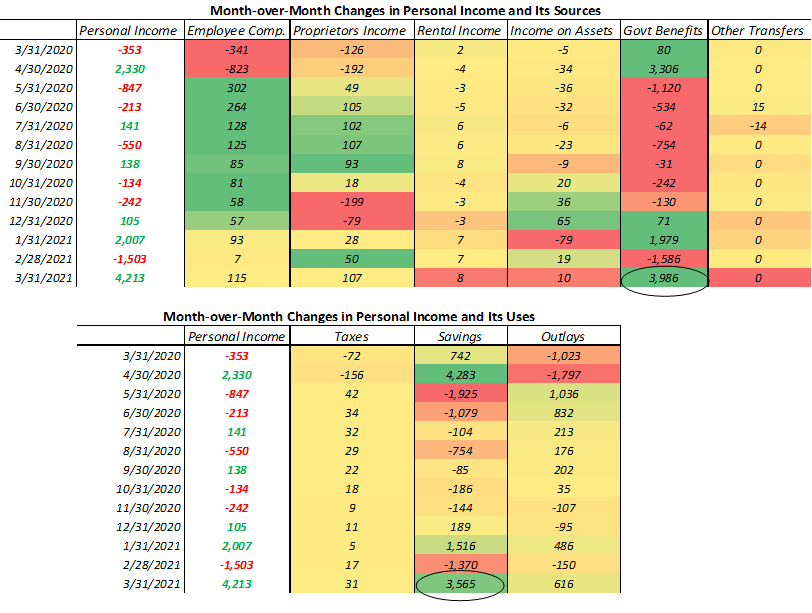

Above, we showed you our Growth Index, which aggregates a wide variety of data to give us a top-line understanding of what is going on at the aggregate level. Lets us take a look at the line items below to the topline number for a moment to understand what is driving our near-cast estimates upwards (in part). Below, we showcase two tables; attributing US incomes to their sources and uses, respectively:

There are two major features to note, both circled. The first is that income increased massively on the back of large fiscal transfers from the government programs. The second is that most of these transfers found their way into savings. The similarity in levels leads us to believe that the increased government transfers prompted higher savings rates. We think of this as potentiation of future demand, much like the last stimulus checks, which we think are finding their way into real spending currently. We see this in the spending data, which we show in the next section.

We Expect the Redistribution of Spending To Continue.

In February, we said, “ First, as the economy re-opens, there is significant room for the redistribution of spending growth from segments of the economy that have benefitted from pandemic lockdowns to sectors that need an open economy to function. While this might be neutral for aggregate spending, it would significantly improve the distribution of income growth. Second, as spending opportunities increase, a vast pool of savings could boost the overall consumption level. Combining these two factors could lead to a significant rise in total spending over the course of 2021, which would support asset markets”.

Further, we also stated,

“There has been a clear substitution of wants—consumers have tried their best to replace items and experiences that were not available due to social distancing with ones that were, resulting in certain parts of the economy gaining at the expense of others. Second, there has been a redistribution of the proverbial economic pie and a shrinking of it. This has happened due to economic damage and ensuing income loss created by the pandemic-driven recession.”

Finally,

"What we would like to highlight about these trends is that they are entirely reversible. As COVID-19 restrictions ease due to vaccinations, it will, in fact, become increasingly likely that these trends will reverse. While the reversal of these trends is a reallocation of economic growth, i.e., it does not grow the proverbial economic pie but redistributes it, we think this will be positive for the overall health of the economy.”

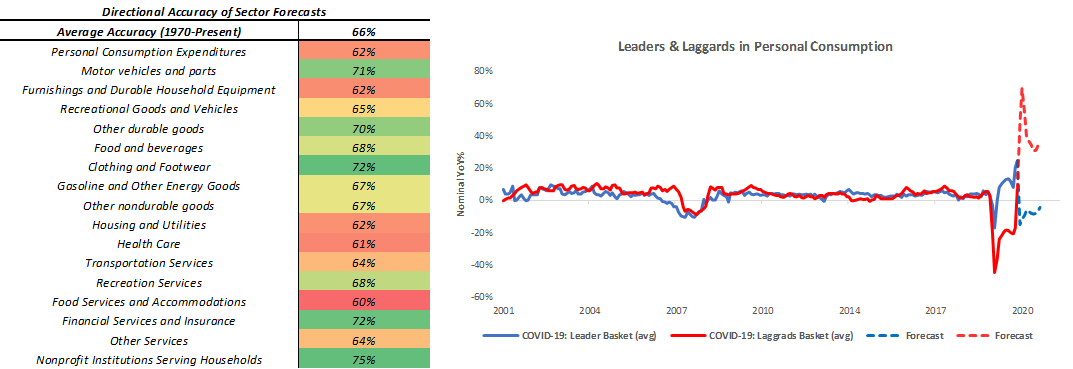

Indeed, we see the reversal of these COVID-19 spending trends today, and we fully expect these to continue:

As we can see above, our expectations for the reversal of these trends are supported by our systematic forecasts- which have largely been directionally accurate across all segments of personal consumption. Our analysis points to continued redistribution of personal spending, with a peak in personal spending growth rates around May.

Markets Imply We Are In A Rising Growth & Inflation Environment.

Using the performance of various asset classes, we can extract what markets are implying which particular economic regime we are in. Below, we show what markets are telling us about the current growth and inflation regime:

As we have mentioned before, we can be in one of four regimes:

(+) G (-) I: Rising Growth, Falling Inflation

(+) G (+) I: Rising Growth, Rising Inflation

(-) G (+) I: Falling Growth, Rising Inflation

(-) G (-) I: Falling Growth, Falling Inflation

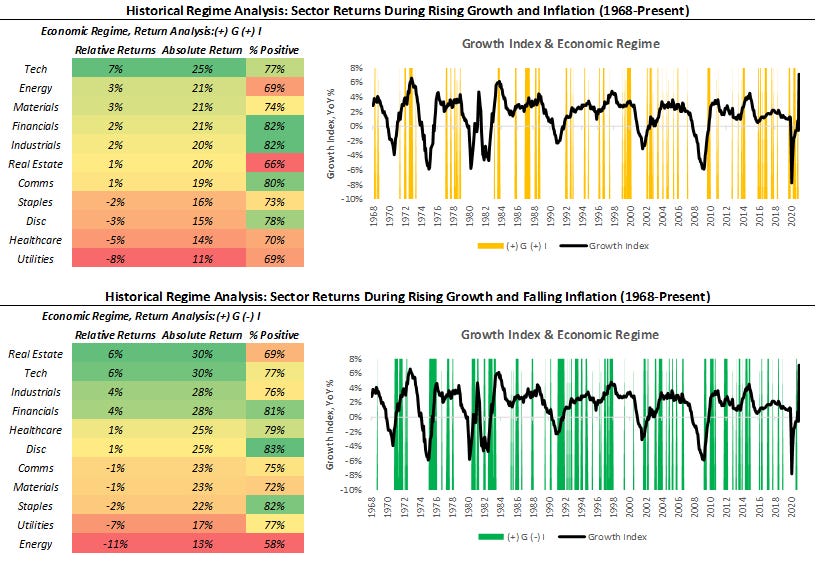

Using our understanding of asset markets, we can classify periods of time into one of the four regimes mentioned above. As we can see in the table above, the balance of probability rests on us currently being in a rising growth and inflation environment. However, depending on our lookback period, we could be in a rising growth and falling inflation environment. Nonetheless, the evidence clearly supports us being a rising real growth environment. Below we show equity sector performance during different economic environments, back to the 1960s. Like 2020-2021period— tech, energy, materials, industrials, and financials typically run hot during rising growth environments:

Indeed, today’s equity markets largely fall in line with what has transpired over history. While on a year-to-date basis, technology remains weak, it saw phenomenal gains during the reflationary periods of last year, consistent with history. Given our growth and inflation outlook, we think this environment and its sector preferences can run a while longer. However, as we said at the outset of this piece, our systematic forecasts point to slower growth and inflation later this year. We touch on what would mean in the next section.

Systematic Forecasts Point To Slowing Growth & Inflation In August.

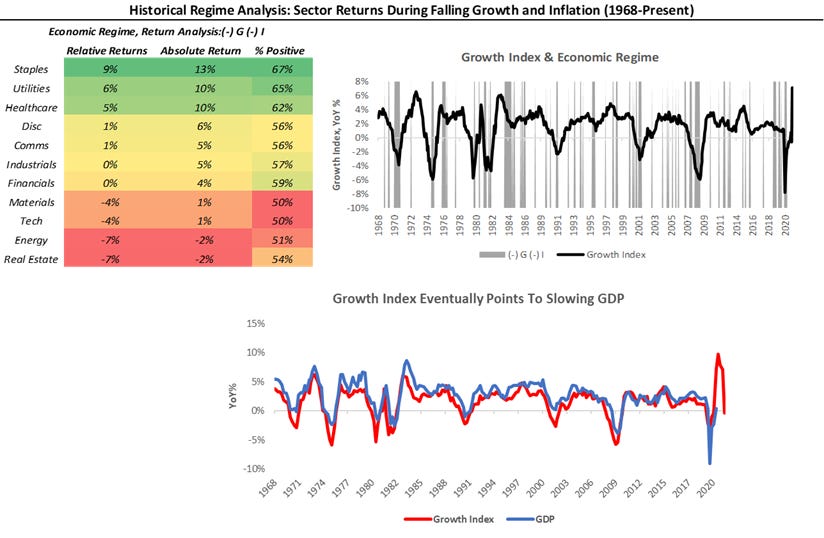

Our systems point to a slowing rate of real growth and inflation in August. There are two things to keep in mind with this forecast. The first is that our systems are dynamic and get more accurate as we get closer to the forecast period. The second is that while they are pointing to slower growth and inflation, they are still pointing to elevated levels of both. Hence, we think that risk could likely remain well supported but could just as likely see a redistribution of sector leadership:

As we can see above, the historically preferred asset allocation during a slowing growth and inflation regime is biased towards counter-cyclical such as utilities, consumer staples, and healthcare. The best performers during rising real growth typically are the worst performers during this period. As we always say, history does not repeat itself, but it does indeed rhyme. We expect the change in sector leadership to be somewhat analogous to what we have seen historically, though we do not expect it to be entirely the same. There remains room for the rising growth environment to continue, but we think it’s important to start preparing well in advance.

Conclusions

To reiterate our findings:

Current economic data is pointing to robust economic growth.

The economic impulse coming from government transfers is massive.

We are now seeing the redistribution of personal spending that we forewarned beginning in January.

Markets continue to imply we are in a rising growth and inflation environment.

Our systematic forecasts are pointing to a slowing rate of growth and inflation in August.

Currently, we are in a rising growth environment, and historically that has favored real estate, technology, energy, materials, industrials, and financials. We are likely moving to an environment that isn’t as favorable and prefers more countercyclical assets such as staples, utilities, and healthcare. There is still significant room for rising growth assets to perform, however, but we think it is important to help you prepare well in advance. As always, our forecasts are dynamic, and we will keep you updated as they change. Until next time.

Excellent piece. I was wondering if you could give some background info on how you come up with your market implied regimes probabilities.

great summary, thank you. on the growth/inflation vs sector performance...any chance you can do the same but for industry group or industry performance to provide more granularity? some sectors are so heterogenous that we are likely missing important parts of the message.