After a pause in our regular coverage, we will resume sharing our upgraded systematic investment process. The Observatory will once again be available to our subscribers. To bring you up to speed on the evolution of our strategic views:

Growth has slowed significantly in 2022, as our systems estimated starting in September 2021. Furthermore, our systems expect growth to remain below trend for the next six months, creating a challenging backdrop for risk assets.

Inflation has remained resilient, outlasting growth in its ability to remain above trend. Our systems estimated a timing mismatch between the deceleration of growth and inflation, the question for H2 2022 is how significant the slowdown in inflation will be.

Liquidity conditions had already begun to tighten in 2021, and their effects are evident in 2022. This dynamic is likely to get worse as the Fed engages in QT.

Markets have priced primarily (+) G (+) I, i.e., rising growth and inflation, as evidenced by the strength in Commodities, Gold, the relative outperformance of the Energy sector, and the sell-off in Treasuries year-to-date. However, tightening liquidity conditions are beginning to show on markets, with yield curves flattening and the dollar generally bid.

Aggregating these conditions, our systems have been positioned dominantly towards Commodities thus far this year while tactically trading Equity Sectors and Fixed Income. We expect this environment to eventually turn into a significant risk-off (one where commodities don’t perform alongside equities and credit). However, we must note that the current regime outlasted any of our discretionary views on the subject; therefore, we continue to let our systems guide us. Now that we have established our strategic thoughts, let’s dive into what our systems are telling us:

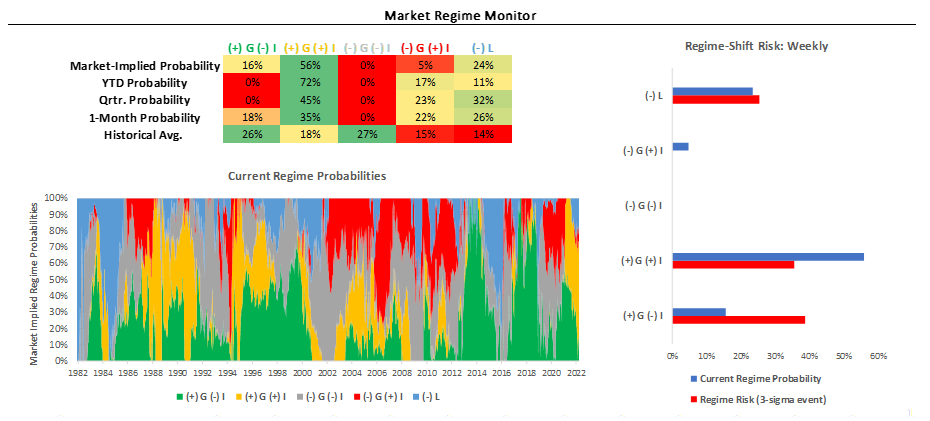

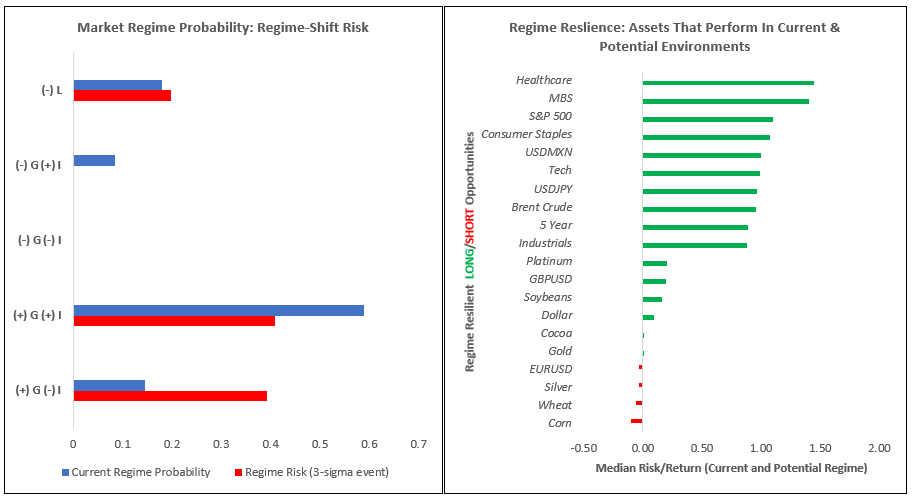

Markets: Over the last month, markets have primarily priced (+) G (+) I. Consistent with this, our Market Regime Monitors tell us we are in a (+) G (+) I regime. Regime Risk is currently elevated, with the potential for a shift to (-) L. In light of the current Regime Risk, the most regime resilient positions are LONG: MBS & 5 Year and SHORT: EURUSD & GBPUSD. Our Trend Monitors show that the strongest UP trends in markets are in Heating Oil & Natural Gas, and the strongest DOWN trends are in Platinum & Communications. Strategically, our systems estimate that the best return/risk characteristics are LONG: Heating Oil & BCOMTR and SHORT: Communications & Treasuries. Currently, the Prometheus Alpha Strategy is LONG: S&P 500, Healthcare, Tech, Energy, BCOMTR, WTI, Brent Crude, Heating Oil, Gasoline, USDMXN. Our Beta Rotation Strategy is currently LONG: Commodities. A Market Regime Portfolio would be allocated to Stocks: 8.4%, Commodities: 57.3%, Treasuries: 0%, Gold & TIPS: 7%, Cash: 27.6%.

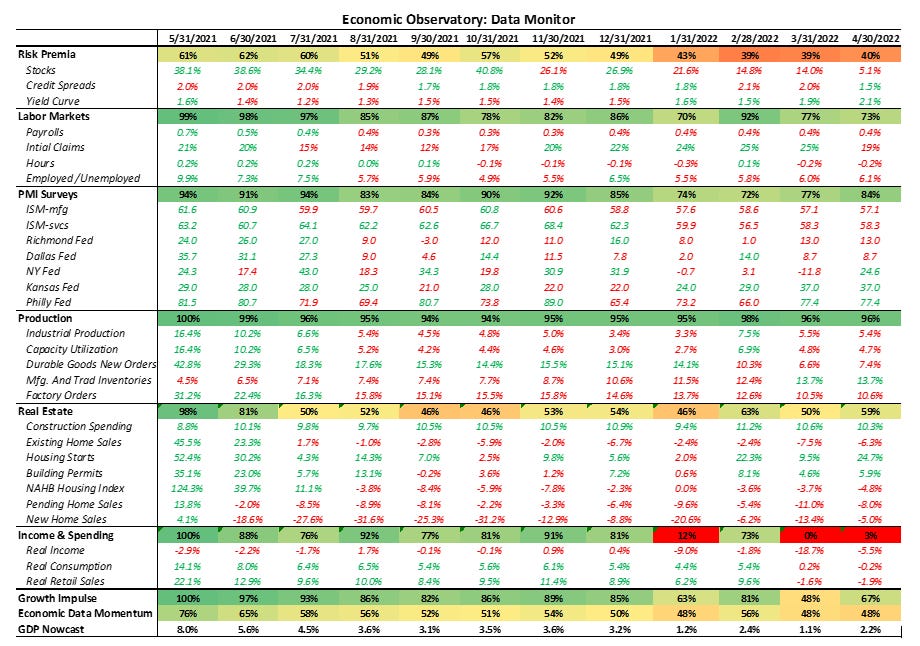

Macro: Our GDP Nowcast currently estimates GDP growth of 2.2%. Further, our GDP Nowcast currently shows a positive Growth Impulse, i.e., growth is above trend. Data has recently surprised to the downside, with Economic Data Momentum at 47.64%. Our Growth Impulse forecasts show growth accelerating but remaining below trend over the next six months. Our Inflation Impulse forecasts show inflation decelerating and remaining below trend over the next six months. Our Liquidity Monitors show that Private & Public Sector Liquidity has deteriorated significantly, showing extremely weak readings. This weakness potentiates future liquidity increases, but this is a ways off.

The future is dynamic, and our systems adjust as new information is available. Our bias is to allocate for the existing regime while trying to peek around the corner at what the future may hold. Finally, we optimize these views to minimize portfolio risk, resulting in our trading signals. We show all this in the pages that follow.

Market Regime Monitor

Using our understanding of asset markets, we can estimate the current market-implied regime in terms of growth, inflation, and liquidity:

· (+) G (-) I: Rising Growth & Falling Inflation

· (+) G (+) I: Rising Growth & Rising Inflation

· (-) G (-) I: Falling Growth & Falling Inflation

· (-) G (+) I: Falling Growth & Rising Inflation

· (-) L: Tightening Liquidity

Markets price these macroeconomic regimes with varying probabilities. We show our estimates for the current market regime below:

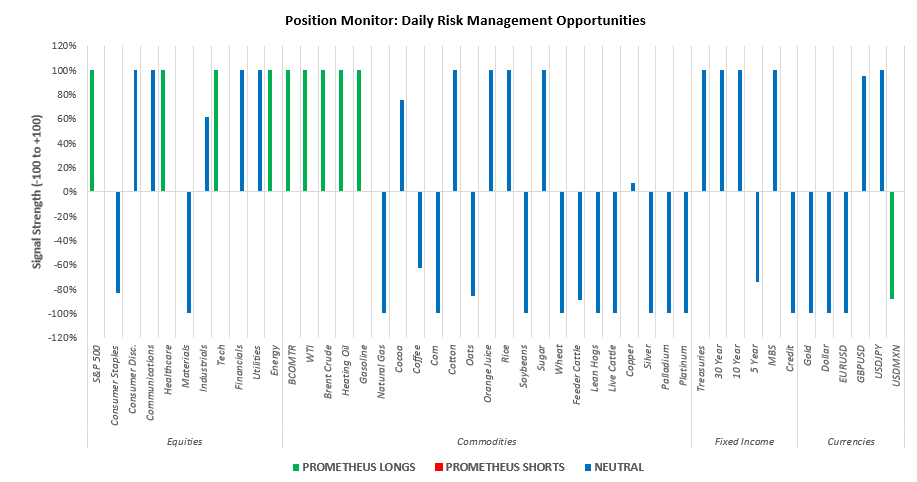

Position Monitor

Below, we show one of our daily Position Monitors, which estimates how cheap or expensive an asset is relative to its expected return, i.e., it is a risk management tool. Assets in the negative territory are ones to book gains in or short, and assets in the positive territory are ones to add to or enter.

Currently, the Prometheus Alpha Strategy is LONG: S&P 500, Healthcare, Tech, Energy, BCOMTR, WTI, Brent Crude, Heating Oil, Gasoline, USDMXN. Our Beta Rotation Strategy is currently LONG: Commodities. A Market Regime Portfolio would be allocated to Stocks: 8.4%, Commodities: 57.3%, Treasuries: 0%, Gold & TIPS: 7%, Cash: 27.6%.

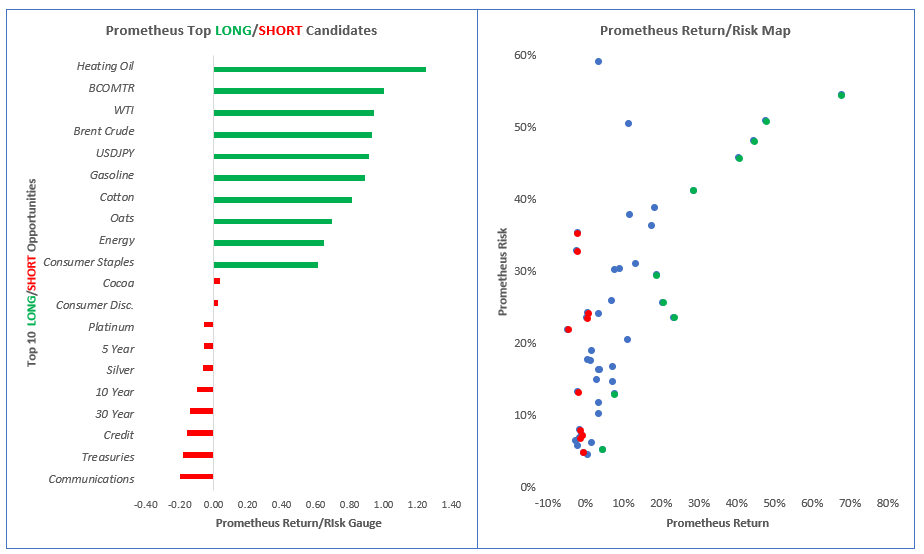

Prometheus Return/Risk Profiles

Using our understanding of market-implied regimes alongside portfolio construction principles, we can create a return-on-risk profile for various assets within a given market regime. We show the current regime's full return/risk profile menu and the top Long & Short candidates.

Strategically, our systems estimate that the best return/risk characteristics are LONG: Heating Oil & BCOMTR and SHORT: Communications & Treasuries.

Regime Risk Management: Regime Resilience

While we know the current regime, we are always running the risk of the regime shifting to one that doesn't support our current allocations. To assess this risk, we use cross-asset correlations to shock the current regime and evaluate the likelihood of a regime shift. Further, we then look at the resilience of assets, i.e., their tendency to perform in the event of a regime shift:

Regime Risk is currently elevated, with the potential for a shift to (-) L. In light of the current Regime Risk, the most regime resilient positions are LONG: MBS & 5 Year and SHORT: EURUSD & GBPUSD.

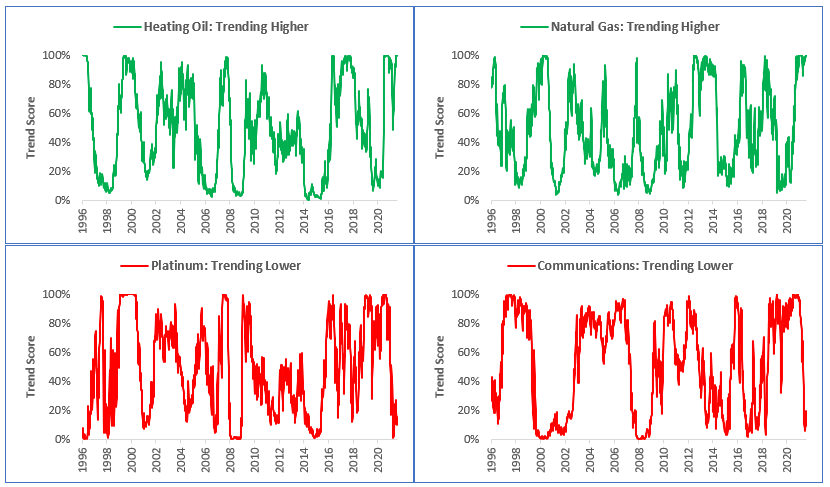

Trend Monitors: Top Trends, Upside & Downside

We also use trend models to augment our market regime signals to assess the degree of multi-duration momentum at the asset class and security level. This gauge allows us to evaluate the degree of trend persistence within a given asset, helping us benefit from solid trends and avoid weak ones. We highlight the top trends in markets today:

Our Trend Monitors show that the strongest UP trends in markets are in Heating Oil & Natural Gas, and the strongest DOWN trends are in Platinum & Communications.

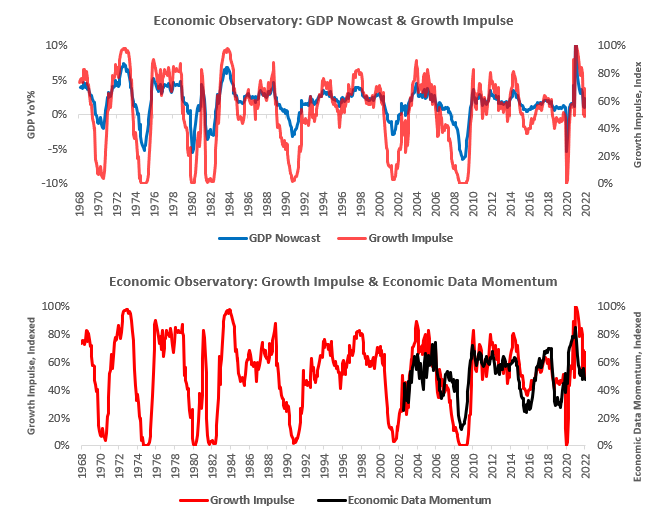

Economic Observatory: GDP Nowcast & Economic Data Momentum

Our economic nowcasting systems aggregate the accelerations and impulses in economic data. However, a significant component of the market's reaction to economic data comes from the evolution of economic data relative to expectations. We standardize this measure to understand momentum in economic data relative to expectations:

Our GDP Nowcast currently estimates GDP growth of 2.2%. Further, our GDP Nowcast currently shows a positive Growth Impulse, i.e., growth is above trend. Data has recently surprised to the downside, with Economic Data Momentum at 47.64%.

Here are some of the underlying data series. Please note that this includes estimates for the most recent months where data is unavailable:

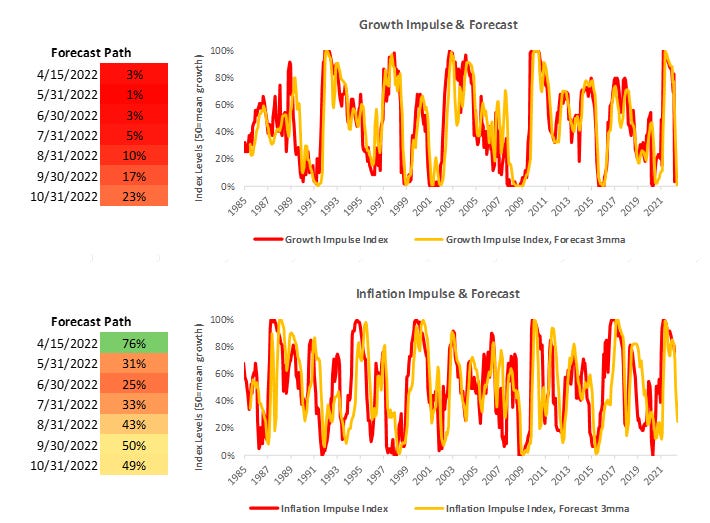

Economic Observatory: Growth & Inflation Forecast Path

Our systematic forecasts for GDP use measures of cyclicality and trend to assess the probable path of Growth & Inflation over the next 6-12 months. We forecast growth and inflation relative to their cycle trends and display their index values, ranging from 0-to 100:

Our Growth Impulse forecasts show growth accelerating but remaining below trend over the next six months. Our Inflation Impulse forecasts show inflation decelerating and remaining below trend over the next six months.

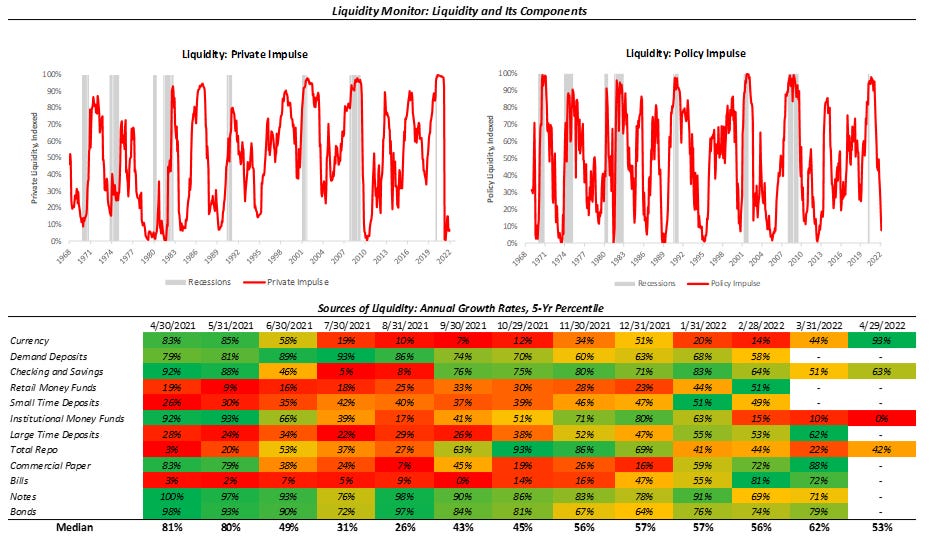

Economic Observatory: Liquidity Monitor

As shown previously, liquidity is a leading indicator of the economic cycle. Therefore, while we systematically forecast growth and inflation, the leading nature of liquidity precludes us from the need to forecast liquidity but rather keep a close eye on its evolution. To track the evolution of what is essentially economic and financial "dry-powder," we have created our Liquidity Monitor, as shown below:

Our Liquidity Monitors show that Private & Public Sector Liquidity has deteriorated significantly, showing extremely weak readings. This weakness potentiates future liquidity increases, but this is a ways off.

Conclusions

We will keep it brief today: Stay nimble!