We apologize for the delay in publishing the Prometheus ETF Portfolio this week. The team is on a short break, and coordinating multiple time zones has proved challenging. We will resume our regular publishing schedule in April and endeavor to be timely until then.

Welcome to our official publication of the Prometheus ETF Portfolio. The Prometheus ETF portfolio systematically combines our knowledge of macro & markets to create an active portfolio that aims to offer high risk-adjusted returns, durable performance, & low drawdowns. Given its systematic nature, we have tested the Prometheus ETF Portfolio through decades of history and have shown its durability. For those of you who are unacquainted with our systematic process, we offer a detailed explanation here:

In this publication, we will discuss the performance, positioning, & risks of the Prometheus ETF Portfolio— and it will be published every week on Fridays to help investors understand how our systematic process is navigating through markets. Before diving into our ETF Portfolio positions, we think it is important for subscribers to understand the context within which our systems choose their exposures. Below, we offer our latest Month In Macro note, which contains the conceptual underpinnings of our systematic process within the context of the latest economic data:

Last week proved to be a strong one as our bets on tightening liquidity paid off handsomely amidst the banking issues today. In our view, these dynamics are a symptom of tightening liquidity, i.e., the source of these issues lies in the financial systems dynamics that we track closely. To understand our views on the true drivers, please reference the note below:

In our assessment, this has not transformed into a systematic credit event and is unlikely to do so. The SVB issues today merely reflect the market-to-market losses of the drawdown in the government’s outstanding liabilities. Unlike the 2008 crisis, the quality of the underlying assets (Treasuries) is not in question.

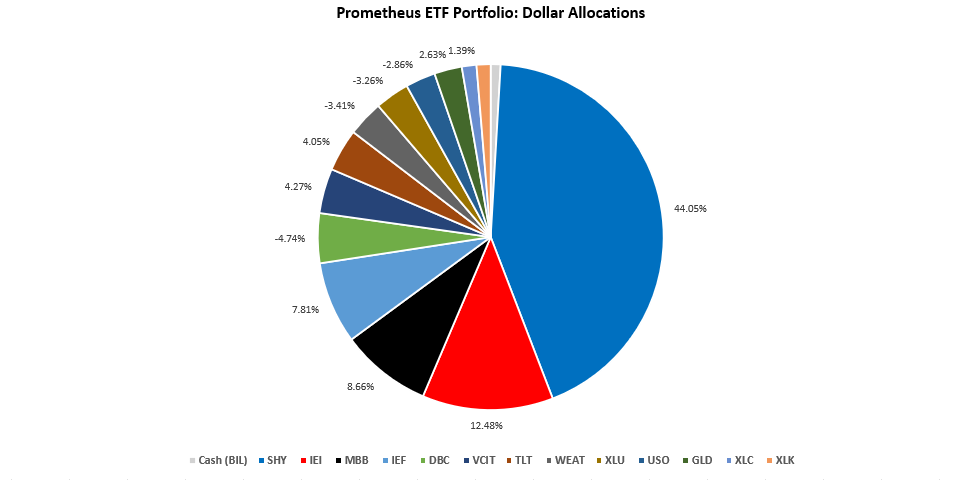

Last week proved to be a strong one for the Prometheus ETF Portfolio, which was up 0.80% amidst a very tough time for stocks on our tightening liquidity bets. Turning to next week our system are looking to positions as follows:

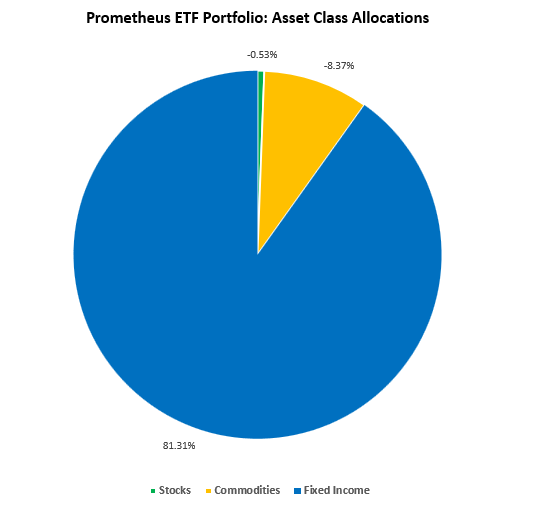

Positions: Cash (BIL): -0.94% SHY : 44.05% IEI : 12.48% MBB : 8.66% IEF : 7.81% DBC : -4.74% VCIT: 4.27% TLT : 4.05% WEAT: -3.41% XLU : -3.26% USO : -2.86% GLD : 2.63% XLC : 1.39% XLK : 1.34%

The portfolio is long short-duration fixed-income securities with modest short positions in commodities and stocks, reflecting tightening liquidity & weaker growth views. A reversal in Fed expectations post-FOMC remains a risk to these positions. More coverage to come. Until then.

I must be misunderstanding what purpose BIL serves, because I don't understand why we're shorting it (-0.94%). I thought it shows up in this portfolio just as a place to park cash, as it yields ~4%.

Thank you for the update.

I was wondering if the backtest performance of this strategy includes commissions and execution fees. This week we rotate like 80% of the portfolio again and if this happens every week I am afraid the performance will decrease a lot compared to a buy and hold strategy.