This series will be updated monthly.

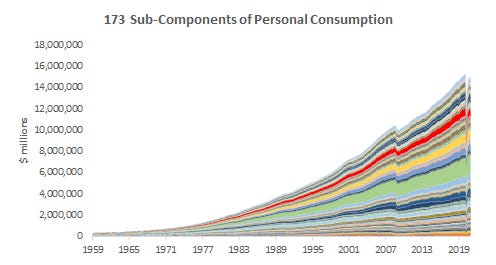

Consumer spending is a vital part of the US economy. For every dollar spent, there is a dollar earned, and at this juncture, it’s essential to understand the distribution of spending and income growth. To do this, we dig into the data—breaking down US consumer spending into its constituent parts. Here’s a visual that shows the granularity of our approach:

We use this granular approach to understand US incomes and spending from the “bottom-up.” This rigorous approach often results in insights that drift, and sometimes directly oppose, conventional narratives created by financial media that largely deal with high-level aggregates. Our nuanced approach leads us to the following findings:

Aggregate spending data continues to be misleading. There is considerable variation under the surface of aggregate data, with some parts of the economy performing extremely well at other parts' expense.

There is large potential spending in the form of precautionary savings. A conversion of this money from savings to spending could be a huge boost for economic output.

These factors continue to build up the potential for large future-spending through two channels. First, as the economy re-opens, there is significant room for the redistribution of spending growth from segments of the economy that have benefitted from pandemic lockdowns to sectors that need an open economy to function. While this might be neutral for aggregate spending, it would significantly improve the distribution of income growth. Second, as spending opportunities increase, a vast pool of savings could boost the overall consumption level. Combining these two factors could lead to a significant rise in total spending over the course of 2021, which would support asset markets.

We look at the data that led us to these conclusions in the next section.

1. Aggregates Continue to Mislead

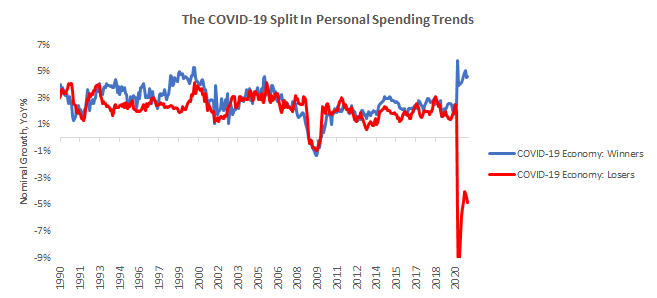

COVID-19 has created a divide in the economy, between areas that can still function during lockdowns and areas that cannot. When we separate sectors this way, the results are striking:

From the above, we take away two things. First, there has been a clear substitution of wants—consumers have tried their best to replace items and experiences that were not available due to social distancing with ones that were, resulting in certain parts of the economy gaining at the expense of others. Second, there has been a redistribution of the proverbial economic pie and a shrinking of it. This has happened due to economic damage and ensuing income loss created by the pandemic-driven recession.

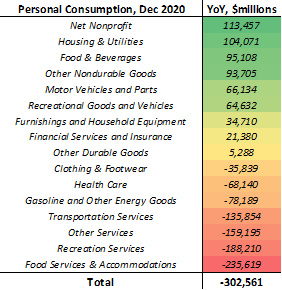

While the above illustration captures the broadest theme in the economy, we show the sector-wise composition of changes in personal consumption spending:

As we can see, consumer spending is far from evenly distributed. Below, we highlight some trends in the substitution trends in consumer spending:

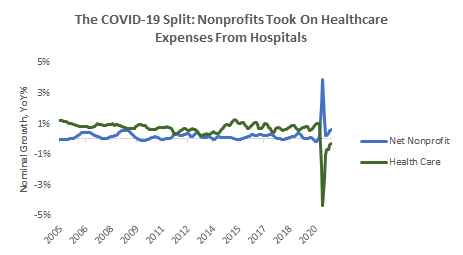

As healthcare spending plummeted as hospitals in the US were overrun with COVID-19 cases, non-profits took on the burden of healthcare services to households. Net nonprofit healthcare spends increased primarily due to the reduction of receipts from consumers, i.e., it came as nonprofits increased their welfare benefits.

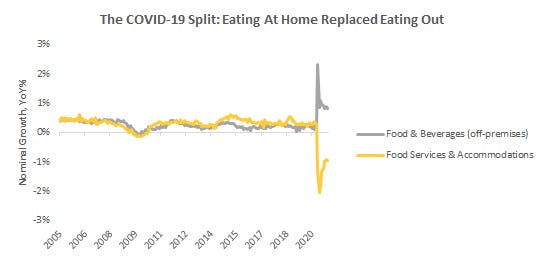

Another strong theme was the shift from eating out to eating at home; we show this below:

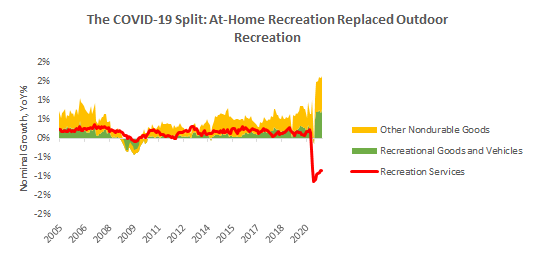

Due to social distancing, there has been a drastic decline in spending on food services and accommodations— spending allocated to food and beverages for off-premises consumption. We see a similar trend in recreational activities and goods:

Recreational goods and vehicles (mostly consumer technology) and nondurable goods (miscellaneous household products) have largely benefitted due to more time spent at home by consumers. This has come at the expense of recreational services (casinos, live entertainment, sports events, etc.).

What we would like to highlight about these trends is that they are entirely reversible. As COVID-19 restrictions ease due to vaccinations, it will, in fact, become increasingly likely that these trends will reverse. While the reversal of these trends is a reallocation of economic growth, i.e., it does not grow the proverbial economic pie but just redistributes it, we think this will be positive for the overall health of the economy.

A redistribution of spending will likely result in more robust economic growth, as more evenly distributed income will foster a more broad-based growth in spending.

2. There Is Extremely Large Potential Spending

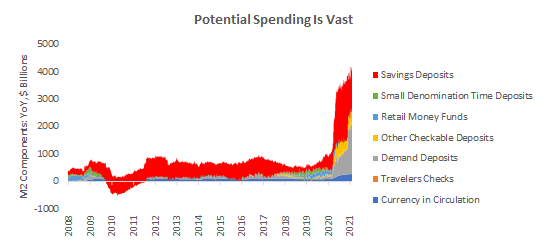

In our previous research, we broke down what is driving the rise in various monetary aggregates. You can check that out by clicking here. Among other things, we showed how the rise in M2 money supply has come from a sizable amount of precautionary savings. Below we offer the same perspective, i.e., we show the composition of changes in M2:

As we can see above, most M2 creation has come from demand deposits and savings deposits. This is cash that can easily make its way back into the real economy if COVID-19 conditions allow for the full reopening of the economy. In this event, we would see a large and temporary surge in the velocity of money- with cash balances being drawn down to fuel personal spending. Hence, there is an extremely large amount of cash that can easily make its way back into personal spending if conditions warrant it. Given the sheer volume of these savings, we think it is inevitable that at least a part of them will find their way back into the real economy, and that is positive for economic growth.

Conclusions

Looking through spending and monetary aggregate data, there looks like there is significant room for spending normalization both in terms of its distribution and its level relative to savings. Redistribution of spending is likely as the US economy emerges from COVID-19 lockdown measures. This will likely coincide with a reduction in precautionary savings by businesses and households, which will result in a reduction of M2 and a significant rise in the velocity of money. Hence, we think there is a potential for US personal consumption expenditures to strengthen significantly as we get further in 2021. We will keep you posted on developments on this front in our monthly update on consumer spending. Until next time!